Committee: State Administration and Veterans' Affairs Interim Committee

Author: Sheri Scurr

Posted on October 29, 2018

The State Administration and Veterans’ Affairs Interim Committee (SAVA) will wrap up the interim when in meets in Helena Nov. 13. Briefings on the funding status of Montana’s nine statewide defined benefit public employee retirement plans top the agenda.

These nine plans cover more than 53,000 active state and local government employees and pay benefits to more than 45,000 annuitants. With combined assets of about $12 billion and liabilities, including future benefit obligations, totaling more than $16 billion, these plans are as follows:

Actuarial valuations are conducted on each plan each fiscal year. A valuation represents a snap shot of the plan’s fiscal health on June 30, the end date of the fiscal year. A plan is 100% funded if current assets cover current and future benefit obligations and expenses. If current assets are insufficient to fully cover all liabilities on June 30 of that fiscal year (keeping in mind these liabilities include benefits that have been earned but are not payable until retirement), then the plan has an unfunded liability. If future contributions and investment earnings are expected to be sufficient to fully pay (i.e., amortize) an unfunded liability within 30 years, the span of a typical working career, actuaries deem the plan fiscally sound.

If an amortization period exceeds 30 years, the plan’s longer-term funding situation should be examined to determine if future experience (such as expected investment returns) could improve the plan’s funding without legislative action, or if a course correction is needed. A course correction may include reducing benefits or increasing contributions, actions that must be done by legislation.

The accompanying table shows the ratio of each plan’s current assets to liabilities and the amortization period for any unfunded liability as of the plan’s June 30, 2018, actuarial valuation.

| Funding Status Based on FY 2018 Actuarial Valuations | ||

System |

Funded Ratio |

Amortization period |

PERS-DB |

74% |

38 years |

TRS |

68% |

31 years |

SRS |

81% |

21 years |

MPORS |

68% |

20 years |

GWPORS |

83% |

72 years |

FURS |

78% |

10 years |

HPORS |

64% |

40 years |

JRS |

161% |

0 years |

With an amortization schedule exceeding 70 years, the fiscal status of GWPORS is of most concern going into the legislative session. At its Nov. 13 meeting, SAVA will learn more about the long-term funding needs of the GWPORS as well as the other plans.

In other matters, SAVA will receive an update from the Secretary of State’s office about plans for allocating a $3 million federal grant for improving election administration and security.

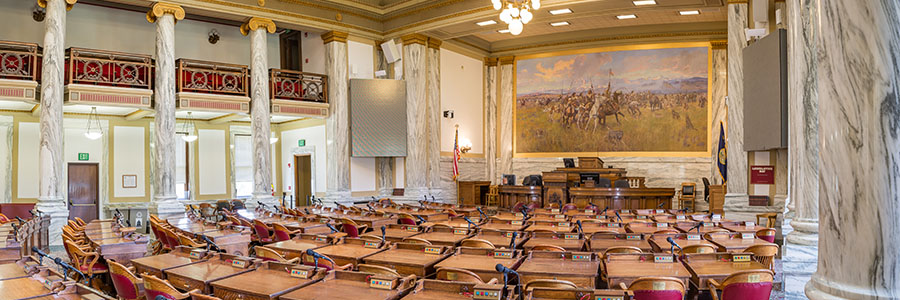

The Nov. 13 meeting is scheduled to begin at 12:30 p.m. in room 102 of the Capitol in Helena. The full agenda and meeting materials will be available on the committee’s website at www.leg.mt.gov/sava. Public comment is welcomed as scheduled on the agenda. Interested parties may listen or watch the meeting by clicking on a live Internet link accessible from the legislative branch home page at www.leg.mt.gov. The meeting may also be broadcast on television by the Montana Public Affairs Network (MPAN).

For more information, please visit the committee’s website at www.leg.mt.gov/sava, or contact Sheri Scurr, committee staff, at 406-444-3596 or sscurr@mt.gov.